Real estate is a hot topic in Canada, with skyrocketing prices and a widespread belief that property ownership is the key to financial success. Whether you’re an experienced investor or a novice, understanding the dynamics of real estate investment can be crucial for your financial planning. While it’s true that real estate can be a profitable investment, it’s critical to approach it with a clear understanding of the risks and potential pitfalls involved. In this newsletter, we’ll explore the allure of real estate investing, examine some common mistakes investors make, and offer an alternative perspective on building wealth through investing.

When it comes to Real Estate, we can break it down into three main uses:

1. A place to live (your home)

- Your business

- An investment

Canadians often combine two or more uses, but this approach can sometimes lead to critical mistakes. Origin Wealth’s business is investing, so we will focus on this in the discussion below.

Real Estate as an Investment

The allure of real estate as a fail-proof investment vehicle has captivated many. While real estate can indeed be a profitable avenue, it is essential to approach it with a balanced understanding rather than an expectation of unbeatable returns.

There are many different types of real estate, including, but not limited to, residential, commercial, and industrial. This newsletter will primarily focus on residential real estate, as it affects all Canadians. However, you can also apply these principles to other types of real estate.

Our emotions and biases often affect our decision-making when investing. Below are some common misconceptions and pitfalls when considering Real Estate as an

investment.

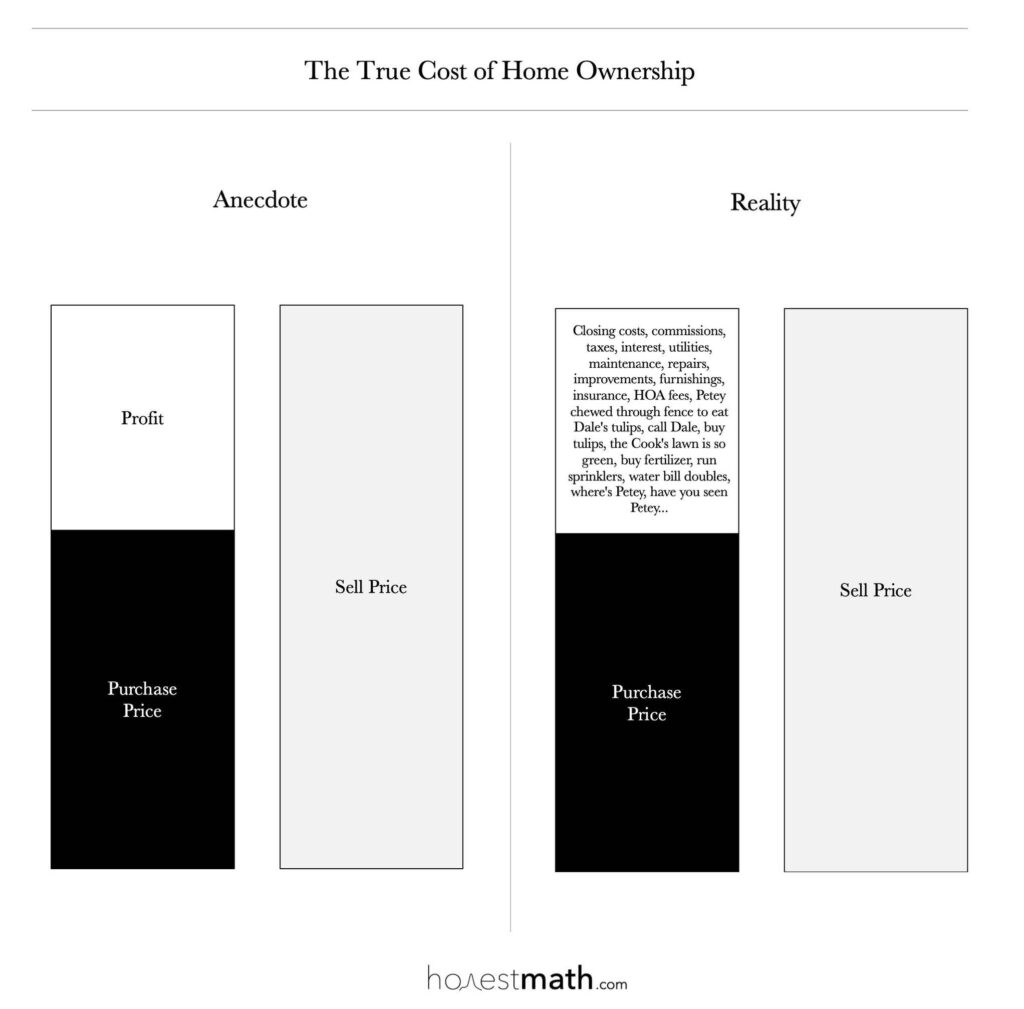

1. Mental Accounting

A common misconception is that calculating profit from real

estate investment merely involves subtracting the purchase price from the selling

price. This oversimplified view overlooks numerous costs associated with property

ownership, such as closing costs, commissions, taxes, interest, utilities,

maintenance, repairs, improvements, furnishings, insurance, and more. To make an

informed decision, you must consider all these costs and calculate the net return on

investment.

1. Risks: Like any investment, there are inherent risks in real estate investing that

many don’t fully consider.

a. Diversification (Lack thereof): Concentration risk arises when too much of

your wealth is tied to a single asset or geographic location. Buying property ties

a substantial amount of money in one asset, on one street, in one tiny corner of

the world. This is akin to putting all your money into one stock.

b. Leverage (Mortgage Debt): Let’s understand leverage with an example.

Suppose you buy a $1 million home, put $200,000 down and borrow $800,000

as a mortgage. If the home’s value increases by 10% ($100,000) to $1.1M,

you’ve made a 50% return on your original $200k investment (not considering

the overhead costs), but if it drops by 10% (-$100,000) to $900,000, you’ve lost

50%. Remember, as history has often shown us, leverage can swing both ways.

c. Illiquidity: Real estate is inherently illiquid, meaning it cannot be quickly

converted into cash**.** Unfortunately, we can’t take our front door off its

hinges, walk down to the grocery store and give it to the grocery clerk to fill our

fridge for the week. If you need to access money from your property, you either

need to borrow against it or sell the asset, which involves time and potentially

significant costs.

d. Interest rate risk: Since 2022, Canada’s central bank has hiked interest rates

ten times. Those with variable-rate mortgages have seen their payments double

and even triple, and those who locked in 3 and 5-year terms around 2% before

the hikes, will renew at potentially much higher rates. As the cost of borrowing

increases, Canadians qualify for lower total mortgage amounts and therefore,

can’t afford prices at the same level. We don’t claim to predict the future here at

Origin, but using history as a guide, we don’t expect a swift return to the lower

rates of a few years ago.

2. Time: Unlike investing in a diversified portfolio of stocks and bonds, real estate

demands a considerable commitment of time and effort for tasks like managing

repairs, dealing with tenants, and administrative tasks. Although hiring a property

manager is an option, this additional cost can significantly reduce the net return on

your investment.

3. Volatility: Contrary to popular belief, property prices fluctuate constantly (as shown

in the chart below), but this volatility isn’t visible daily like a portfolio of stocks and

bonds. The only time you know the actual value of your property is when you sell.

Therefore, real estate may seem less volatile than it is in reality.

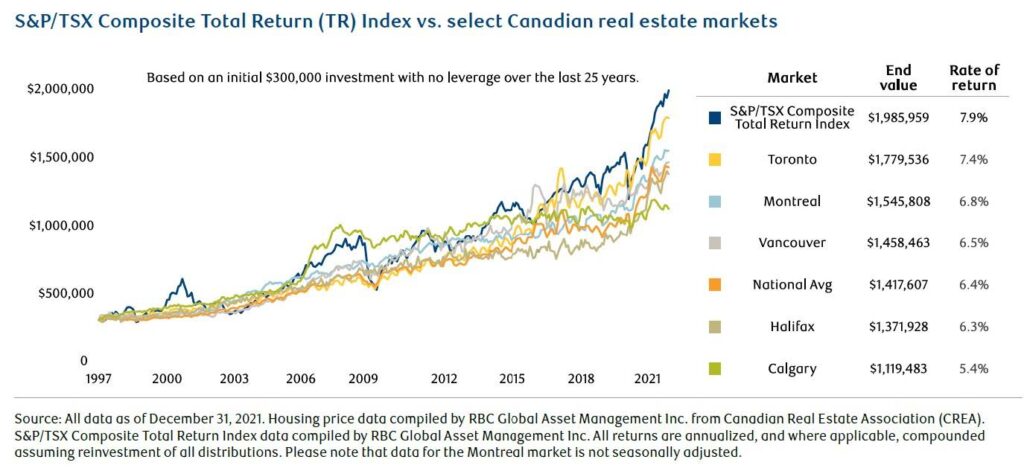

4. Performance: The chart below shows the performance of real estate markets in

major Canadian cities (minus leverage), compared to investing in the Canadian

stock market, represented by the TSX (Toronto Stock Exchange), since 1997. We

consistently advocate that equities are the greatest wealth-creation tool on the

planet, and the data backs up this assertion.

It’s crucial to rethink our perspective on real estate. It’s a business; like any business, it

requires a significant commitment of time, effort, and resources.

I’ve owned real estate before and I’ll own it again, but I don’t view it as an investment.

It’s where I eat, sleep, raise a family, create memories, and store my belongings. From

an investment perspective, I feel more comfortable owning a portfolio of thousands of

real, cash-flowing businesses around the world that don’t call me when there’s a leak in

the ceiling. They’ve proven to generate a higher return with more flexibility, less effort,

and less risk.

As we’ve seen, making informed investment decisions isn’t magic—it’s a skill. It requires

understanding, patience, and clear financial planning.